Step-Up in Basis: Definition, How It Works for Inherited Property

€ 19.00 · 5 (680) · Auf Lager

:max_bytes(150000):strip_icc()/TermDefinitions_Stepupbasis-6fc33c446de546c7a4c63c41c4474cd2.jpg)

:max_bytes(150000):strip_icc()/how-the-stepped-up-basis-loophole-works-357485_final-5b18f0c3fb1342c28b54de1317600f5b.png)

What Is a Step-Up in Basis?

IRS confirms that completed gifts to grantor trusts are not eligible for Section 1014 step-up

Bethel Law Corporation - How to Minimize Inheritance, Estate & Capital Gains Taxes

What Investors Should Learn From The Failed Bid To End Stepped-up Basis – Forbes Advisor

Biden Administration May Spell Changes to Estate Tax Exemptions and Basis Step-Up Rule - PBWS - Albuquerque & Santa Fe Law Firm - Trust, Probate, Estate, Elder Law

What is a Step-Up in Basis and Does It Apply in San Diego?

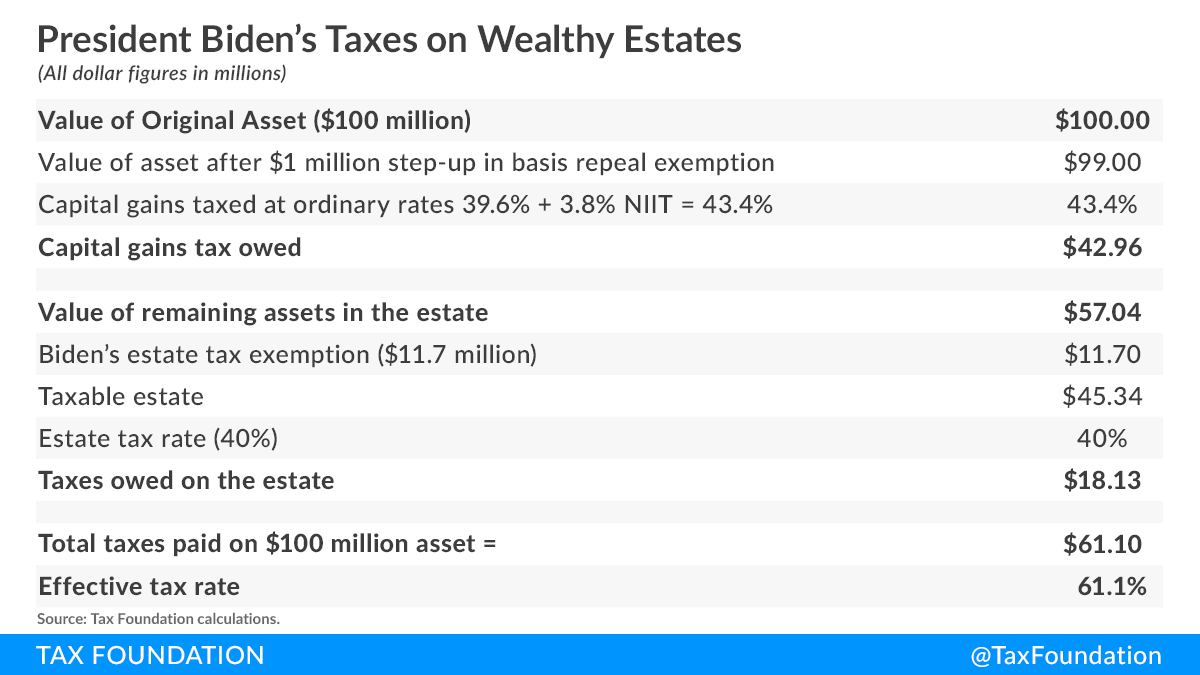

Biden Estate Tax? 61 Percent Tax on Wealth

Step Up Basis - How to Minimize Tax Liability - BB&C

Step-up in Bases - How It Works , Inherited Properties

Biden Administration May Spell Changes to Estate Tax Exemptions and Basis Step-Up Rule - PBWS - Albuquerque & Santa Fe Law Firm - Trust, Probate, Estate, Elder Law

Do I Pay Taxes Automatically If I Inherit Property?

Do Assets in a Living Trust Get a Step-Up in Basis? - Litherland, Kennedy & Associates, APC, Attorneys at Law

State Taxes on Inherited Wealth Center on Budget and Policy Priorities

What's stepped-up basis?

Carryover Basis - FasterCapital

:max_bytes(150000):strip_icc()/how-to-end-friendship-4174037-final-4dcc4767426449dbb7c987cc834ebe31.png)